by Calculated Risk on 1/23/2025 11:31:00 AM

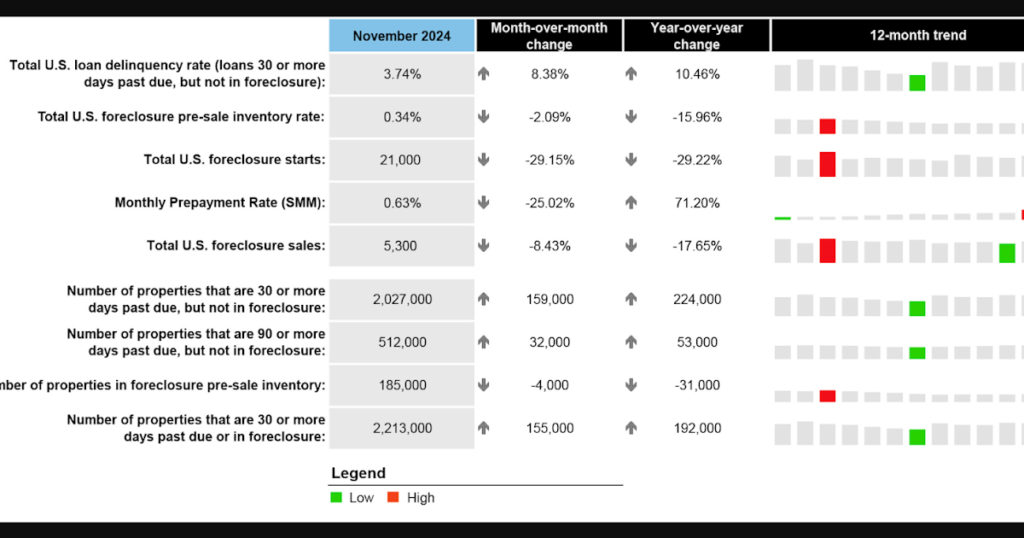

From ICE: ICE First Look at Mortgage Performance: Delinquencies Ended 2024 on a Strong Note Despite Remaining Near a Three-Year High

• The national delinquency rate eased 2 basis points (bps) to 3.72% in December, but rose 4.0% year over year – the seventh consecutive annual increase – ending 2024 near a three-year high

• Early-stage delinquencies fell 41K (-3.6%) in the month, while serious delinquencies (loans 90+ days past due but not in active foreclosure) continued their slow climb – up 29K (+5.7%) in the month and a fifth consecutive rise year over year

• Foreclosure sales declined by 5K (-5.6%) in December, hitting their lowest level in nearly two years, while foreclosure inventory climbed 7K (+3.8%), but was down -10.7% year-over-year

• Despite rising in December on volatility around the holidays, foreclosure starts averaged 26,800 per month in 2024, down from 28,500 in 2023 and lower than any year outside the pandemic moratoria

• Prepayment activity (measured by single-month mortality or SMM) fell to 0.57% on rising interest rates, down -9.8% in the month but up 47.2% from the same time last year

emphasis added

Click on graph for larger image.

Here is a table from ICE.